Riding the Tiger

Clinging to the wreckage of Civilization.

“To ride the tiger means to seize the forces of collapse and chaos without being devoured by them, to grip the beast not in fear, but in mastery.

He who rides must not seek to kill the tiger, but to remain atop it, poised, still sovereign, as the world beneath him disintegrates.

For if he dismounts, the tiger will turn and tear him apart.”

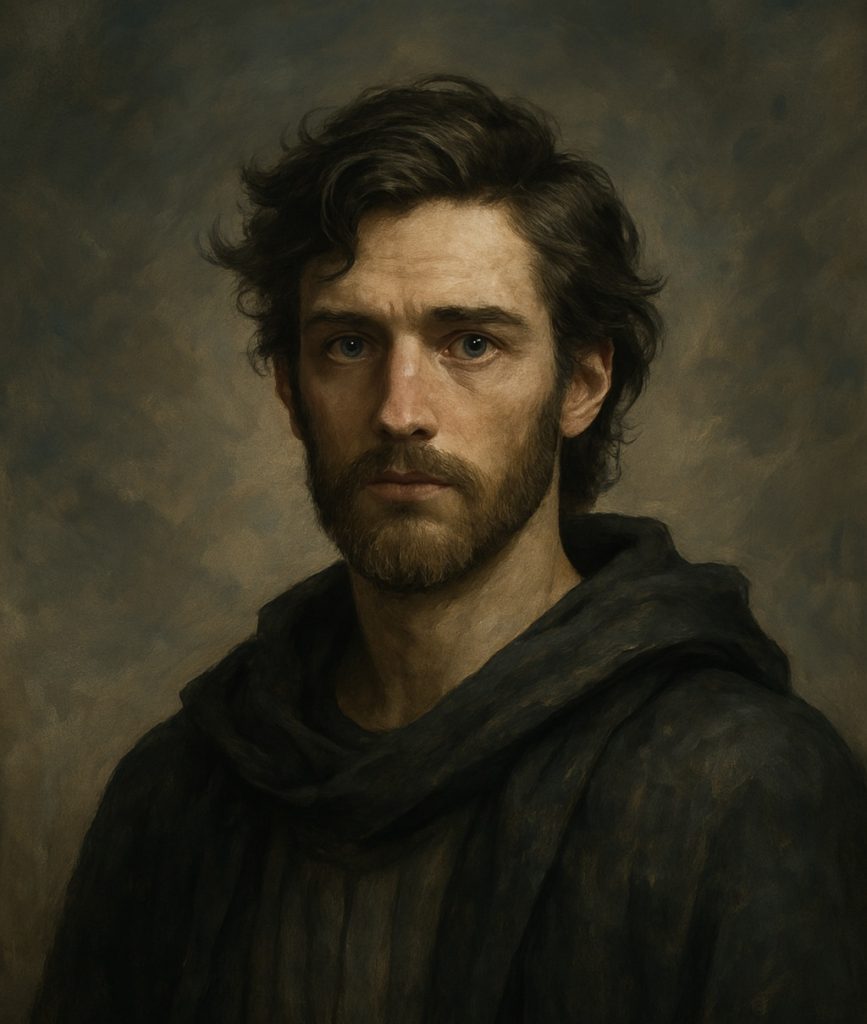

To the weary traveler, Welcome.

There are others like you.

Those who remember, those who endure.

Quiet flames in the dark. Who carry the fire where light has fled.

Torchbearers.

You were not made for this age of noise and forgetting.

You were made for the higher road, the path of honor, virtue, and remembrance.

If your spirit stirs at these words… then you have found your way home.

Caelum

A society grows great when old men plant trees whose shade they know they shall never sit in.

Ancient Greek Proverb